Germany’s imminent 5G spectrum auction comes under fire

Key global research cements FTTB business case: NetComm Wireless

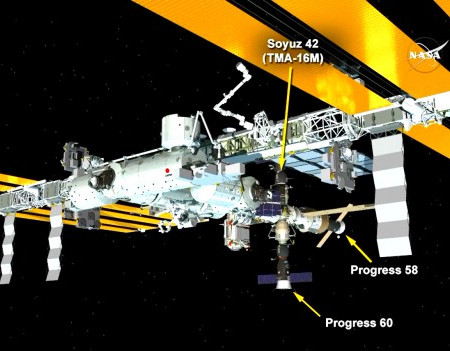

Sojuz delivers final European MetOp satellite into orbit

Africa set for 5G but 3G, 4G to be key mobile broadband drivers: Ovum

Ciena supplies WaveLogic Ai optical tech to Deutsche Telekom Global Carrier

T-Mobile Poland marks 6,000th base station with carrier aggregation

Interxion’s Marseille DCs to cash in on ‘fastest growing European interconnection hub’

Deutsche Telekom, Aricent target service providers with 5G-focused Edge compute platform

Norway comms regulator extends use of 2300–2400 MHz band until 2022

%d bloggers like this: