San Jose based cloud unified comms specialist 8×8 is focusing firmly on the ongoing global trend of enterprises opting to move their traditional, on-premise communication services to the cloud, an opportunity the firm is tipping as a $60 billion addressable market.

Highlighting the release of the firm’s Video Meetings web conferencing service, 8×8 VP Asia-Pacific Brendan Maree told Telecom Times he believed this market currently has been less than 10% take up by cloud.

“We see a massive opportunity, for us the revenue opportunity is making it easier than ever to transition to the cloud, knowing that this will bring enterprises innovation faster, at a lower cost, still confident in the knowledge that all of their critical data is secure. “

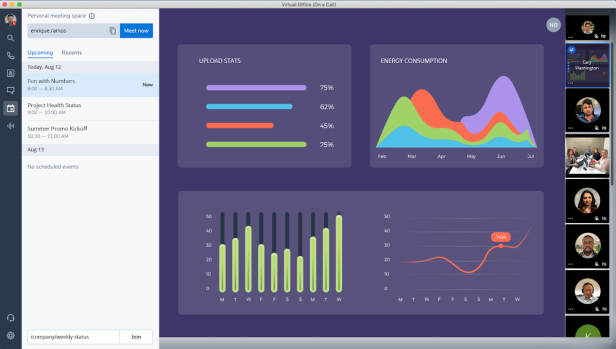

“Enterprises increasingly want to interact across multiple channels with their customers – voice, video, chat, etc. We are making this easier than ever before by providing a single platform solution,” he said.

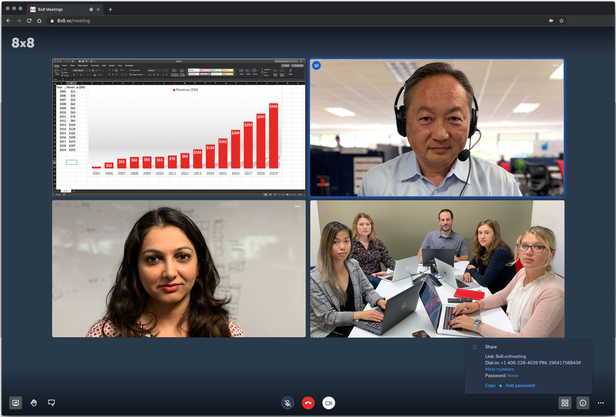

Maree said 8×8 Video Meetings was fully-integrated with the company’s raft of desktop and mobile all-in-one applications, “providing a highly-competitive video offering in the market.”

“It enables teams to collaborate effortlessly with crystal clear video and audio quality from a single application for voice, chat and video collaboration,” he said.

Maree said the new release of the web conference service was based on Jitsi open source video communications tech, 8×8 acquired from Australian issue tracking specialist Atlassian late last year.

“8×8 has integrated and reimagined the new videoconferencing solution into our X Series service plans and the 8×8 all-in-one communications app during the last 11 months,” he added.

“In general, we believe it is important both to have internal innovation and to be constantly scanning for good technology on the outside. By maintaining balance you get the best of both worlds. If you only innovate externally, it is much harder to maintain and extend a seamless platform,” Maree said.

Touching on the firm’s overall M&A strategy, he noted the company had absorbed 8 acquisitions in 8 years. “These have provided us ownership of our technology stack for voice, video, chat and contact centre, and most recently an API platform via our acquisition of Wavecell,” Maree said, referring to the Singapore-based cloud comms provider it snapped up last July in a deal worth about $125 million.

“We have a different approach than competitors in the market – ownership of one platform – and we are seeing this translate into mid-market and enterprise ARR growth.”

In terms of the company’s global near term strategy, Maree said it viewed the improved video offering, now integrated into its cloud platform, as an key competitive advantage because of the tight integration with the firm’s other communication services.

“We are seeing increased needs from the Health, Education and distributed businesses throughout Australia and New Zealand,” he said.